Update on imBTC Operations: Tokenlon to cease cross-chain gateway services

Let’s take a look back. Now that Ethereum’s gas fee seems to have reclined, and the first wave of the DeFi craze seems to have concluded.

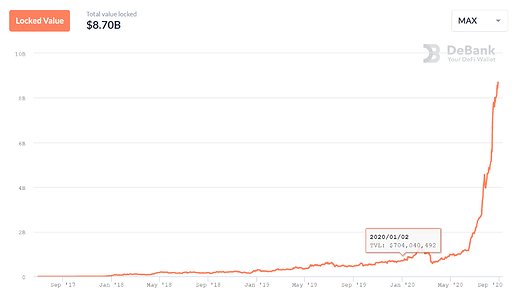

Over the last weeks, we saw DeFi usage explode. The locked-up market value (TVL) of DeFi jumped from $1 billion in June to nearly 7 billion US dollars. Due to liquidity mining projects such as Curve and the “short-lived” YAM, lock-up value in DeFi jumped to new heights.

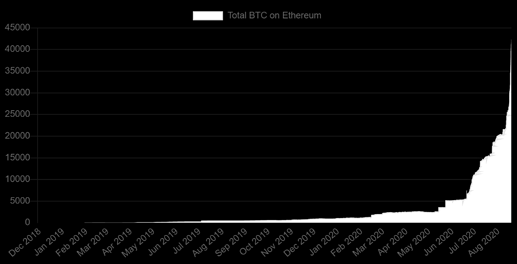

Note that Curve opening liquidity mining and launching CRV have led to a sharp increase in the issuance of BTC-anchored coins on the Ethereum network .

According to DeBank data, on August 13th, the circulation of BTC tokens on the Ethereum network was 26,853, of which 21,105 were WBTC and 2,501 were renBTC. After CRV went online, this data reached 28,359 (WBTC) and 10,014 (renBTC) on August 17, and the total issuance of BTC tokens exceeded 4w. Among them, renBTC has increased by more than 300%. As a bridge between BTC and WBTC, the demand for renBTC has increased sharply.

Why BTC on Ethereum?

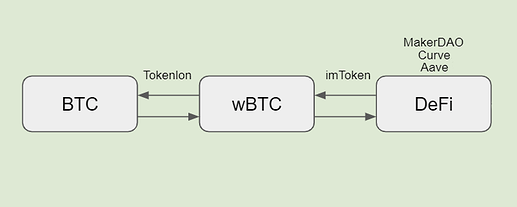

For most investors, the returns from holding BTC over the long-term is more attractive than playing the short-term altcoin markets. Because of the limits of the bitcoin blockchain, however, they are drawn to participate in DeFi on Ethereum. On Ethereum, the user can earn interest in a non-custody fashion while staying long BTC.

Thanks to BTC on Ethereum, users can now participate in DeFi in a non-custodial fashion.

What is a BTC token?

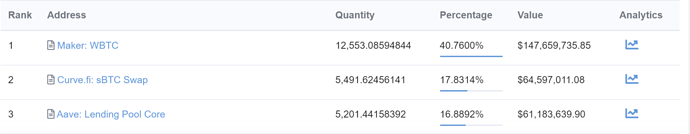

BTC tokens are ERC20 tokens whose value is anchored to BTC’s value in a 1:1 fashion. The most popular BTC tokens include WBTC, renBTC and imBTC (see BTC on Ethereum ) .

The birth of BTC token on Ethereum allowed BTC holders to participate in the Ethereum DeFi ecosystem and obtain stable additional income without losing exposure to BTC.

In the beginning, users would deposit BTC tokens into the DeFi protocol (MakerDAO, Aave, etc.) to earn interest or to lend other tokens.

The launch of Curve liquidity mining adds the option of obtaining higher returns via liquidity mining.

BTC tokens bring traffic and users to the entire DeFi industry. But right now, BTC tokens on Ethereum are responsible for less than 7% of the market value of DeFi. And DeFi only accounts for 2% of the market value of the entire digital currency space.

Compared to BTC, which accounts for more than half of the market value of the entire digital currency, BTC tokens have a huge room for development.

What are the current ways to obtain BTC tokens?

WBTC, the first and currently most popular BTC token, has been supported by many DeFi projects as acceptable collateral. It can even be used to participate in liquidity mining on some platforms.

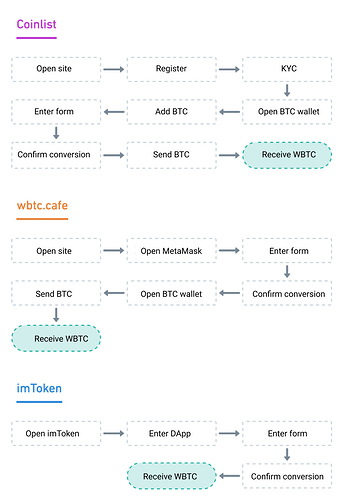

However, for now, exchange BTC to wBTC — and reverse — hasn’t been too easy. There have been 2 main ways, and we add a third one:

We present: BTC<->WBTC minting on Tokenlon

Compared to obtaining WBTC from Coinlist, WBTC minting on Tokenlon is quick, easy and more decentralized. On top, the fee is better too.

- Single maximum limit (for now): 50 BTC

- BTC minting WBTC rate: 0.2% + miner fee

- WBTC redemption rate: 0.3% + miner fee

Due to the native support of Tokenlon in imToken wallet, users can convert WBTC to immediately trade and participate in DeFi.

Risk reminder

Any profit-making is accompanied by risks. DeFi is essentially based on smart contracts. If there is a problem with the code, assets stored on DeFi contracts can be in danger.

Liquidity mining is the result of a combination of multiple DeFi protocols. This combination adds additional risk. Be reasonable in allocating assets and controlling your risk. In other words: Do your own research and only invest what you can afford to lose.